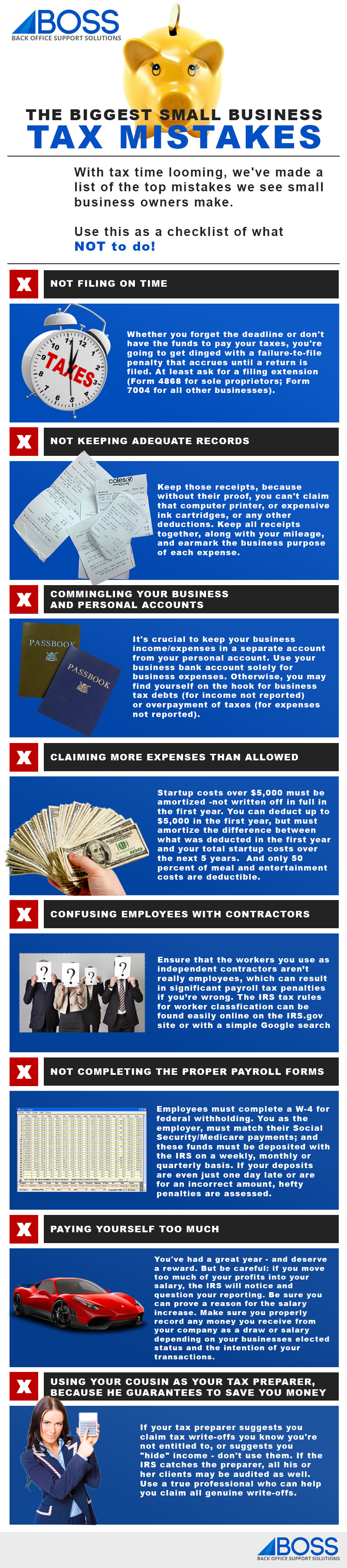

Here at Back Office Support Solutions, we’ve made a list of the top mistakes we see small business owners make. Use this as a checklist of what NOT to do!

- Not filing on time. Whether you forget the deadline or don’t have the funds to pay your taxes, you’re going to get dinged with a failure-to-file penalty that accrues until a return is filed. At least ask for a filing extension (Form 4868 for sole proprietors; Form 7004 for all other businesses).

- Not keeping adequate records. Keep those receipts, because without their proof, you can’t claim that computer printer, or expensive ink cartridges, or any other deductions. Keep all receipts together, along with your mileage, and earmark the business purpose of each expense.

- Commingling your business and personal accounts. It’s crucial to keep your business income/ expenses in a separate account from your personal account. Use your business bank account solely for business expenses. Otherwise, you may find yourself on the hook for business tax debts (for income not reported) or overpayment of taxes (for expenses not reported).

- Claiming more expenses than allowed. Startup costs over $5,000 must be amortized -not written off in full in the first year. You can deduct up to $5,000 in the first year, but must amortize the difference between what was deducted in the first year and your total startup costs over the next 5 years. And only 50 percent of meal and entertainment costs are deductible.

- Confusing employees with contractors. Ensure that the workers you use as independent contractors aren’t really employees, which can result in significant payroll tax penalties if you’re wrong. The IRS tax rules for worker classification can be found easily online on the IRS.gov site or with a simple Google search.

- Not completing the proper payroll forms. Employees must complete a W-4 for federal withholding. You as the employer, must match their Social Security/Medicare payments; and these funds must be deposited with the IRS on a weekly, monthly or quarterly basis. If your deposits are even just one day late or are for an incorrect amount, hefty penalties are assessed.

- Paying yourself too much. You’ve had a great year – and deserve a reward. But be careful: if you move too much of your profits into your salary, the IRS will notice and question your reporting. Be sure you can prove a reason for the salary increase. Make sure you properly record any money you receive from your company as a draw or salary depending on your businesses elected status and the intention of your transactions.

- Using your cousin as your tax preparer, because he guarantees to save you money. If your tax preparer suggests you claim tax write-offs you know you’re not entitled to, or suggests you “hide” income – don’t use them. If the IRS catches the preparer, all his or her clients may be audited as well. Use a true professional who can help you claim all genuine write-offs.